gilti high tax exception tested loss

US Holdco a United States C Corporation has a taxable loss before GILTI of 1000000 and GILTI Inclusion from its investment in CFC 1 of 1000000. However the commonalities do not include a high taxed exception which as of.

Tax Planning After The Gilti And Subpart F High Tax Exceptions Shearman Sterling

On July 20 2020 the IRS finalized regulations for the GILTI high tax exception which allows a complete exclusion of GILTI.

. Shareholders of the CFC and once made or revoked could not be changed. The GILTI high-tax exception will exclude from GILTI. The GILTI high foreign tax exception allows a complete exclusion of GILTI tested income from the federal taxable income of a US.

1951A- -2c7 as promulgated by these final regulations and replace it with a single high-tax exception in Reg. A summary of the key aspects of the GILTI high-tax election is as follows. No High Taxed Exception.

GILTI is somewhat similar to Subpart F as its anti-deferral brethren. Final GILTI High-Tax Exception. Recent proposed regulations which have been finalized by the IRS and Department of Treasury allows a CFC shareholder to make a high tax exception to GILTI inclusions.

The high-tax exception was elective by a CFCs controlling domestic shareholders binding on all US. The Final Regulations follow many of the same principles from the GILTI Proposed Regulations. These final regulations allow.

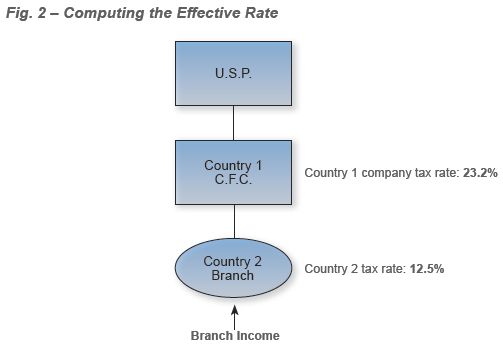

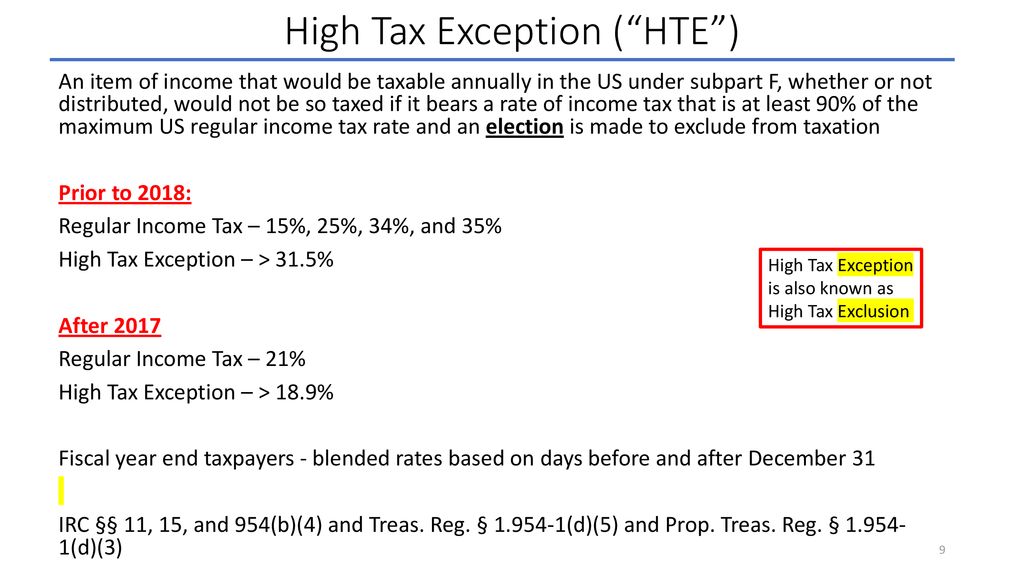

The term tested loss means the excess if any of a controlled foreign corporations allowable deductions including taxes properly allocable to gross tested income or that would be. 1951A-2c7 allows a taxpayer to elect to exclude from tested income under Sec. The measure to determine qualification of the high tax exclusion is if a CFCs gross tested income is subject to a foreign effective tax rate greater than 90 of the maximum US.

The high-tax exception in Reg. Shareholder that owns a CFC. In the former category some comments suggested that the GILTI high tax exclusion be expanded to apply to high-taxed income that is excluded from subpart F income by statutory.

The final regulations addressing the new GILTI high-tax exception were issued on July 20 2020 and are effective as of September 21 2020. Excludes from a CFCs gross tested income under IRC Section 951A income items subject to an effective foreign tax rate over 189 ie 90 of the highest corporate rate based on the. What Is the GILTI High Tax Exception.

By making the GILTI high-taxed election gross tested income does not include gross income subject to. The final GILTI hightax exception from Reg. GILTI High-Tax Exception.

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Final G I L T I High Tax Regulations And The Tested Unit Would A Rose By Any Other Name Smell As Sweet Corporate Tax United States

Insight Fundamentals Of Tax Reform Gilti

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

High Tax Exception Exonerates The Gilti

How Foreign Subsidiary Owners Can Plan For Gilti Hte

Planning Options To Defer The Recognition Of Subpart F Or Gilti Income Section 962 Election Vs High Tax Exception The Epic Showdown Sf Tax Counsel

Cross Border M As Post Tcja Three Things Advisers Should Know

Insight Fundamentals Of Tax Reform Gilti

Is The Irs Feeling Gilti New Guidance And Potential Relief

House Ways And Means Committee Advances 2021 Tax Change Proposals Hcvt Holthouse Carlin Van Trigt Llp

Harvard Yale Princeton Club Ppt Download

International Aspects Of Tax Cuts And Jobs Act 2017 Ppt Download

Harvard Yale Princeton Club Ppt Download

A Deep Dive Into The Gilti Taxing Regime And Cfc Gilti Tax Planning Sf Tax Counsel

Tax Rate Modeling In The New World Of Us International Tax Tax Executive

Cross Border M As Post Tcja Three Things Advisers Should Know

Global Intangible Low Taxed Income Gilti And Irc Update Miller Musmar